There is a good possibility that you or your spouse will eventually require some form of long-term care. According to the U.S. Department of Health and Human Services, about 70% of people aged 65 or older will enter a nursing home for some period of time during their lifetimes.1 Whether you or your spouse will be among this group is …

Planning the Withdrawal of Your Retirement Assets

You’ve worked long and hard to accumulate your retirement assets that you are using to help finance your retirement. Now, it’s time to start drawing down those assets. Exactly how you liquidate your assets will affect your tax and impact how long those assets last, so it pays to plan a withdrawal strategy that is efficient and maximizes the benefits …

What Today’s Workers Can Expect From Social Security Tomorrow

Did you know that the age at which many workers will qualify for full Social Security benefits has risen to 67 from 65? If that’s news to you, you’re not alone: The majority of workers are still in the dark about Social Security eligibility requirements and many expect to qualify for benefits payments sooner than they actually will. Combined with …

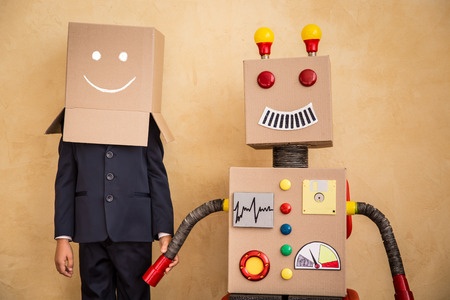

The Low Down on Robo-Advisor

The trend toward online investing and advisory services, also known as robo-investing and robo-advice is gaining momentum, but industry participants are struggling to get a handle on how retail investors view and/or use robo-services to conduct their financial affairs. Studies Abound Recent research conducted by major asset management firms has given some insight, yet often their findings turn up …