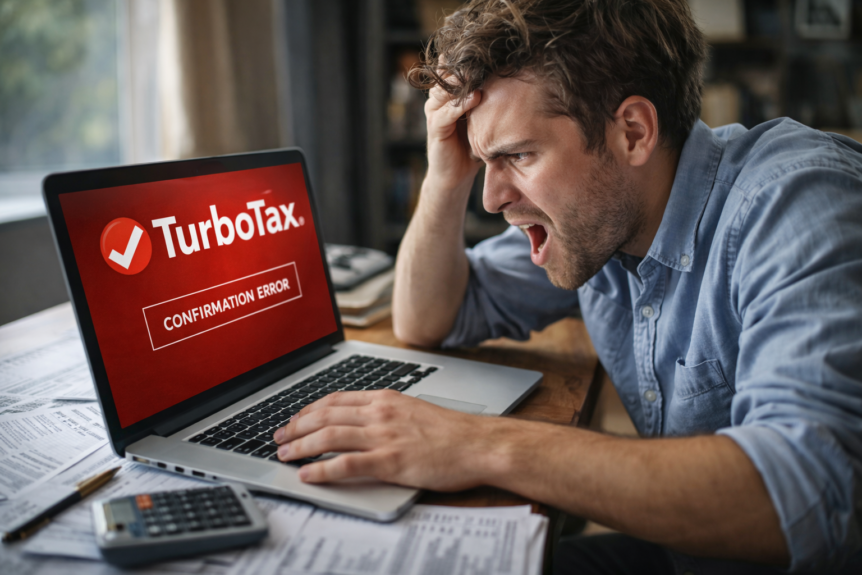

Tax software is convenient, affordable, and effective for many people. But it isn’t designed to scale with complexity. So how do you know when it’s time to move on?

TurboTax works best when life is predictable

DIY tax software is ideal when:

- Income is straightforward

- Financial changes are minimal

- Decisions are mostly mechanical

As soon as taxes require judgment, not just data entry, software reaches its limits.

Signs it may be time to work with a professional

People often outgrow tax software when they find themselves:

- Unsure how to answer certain questions

- Re-running scenarios to see what changes

- Googling “what happens if…”

- Feeling uneasy after filing

- Wondering if they missed something important

These are signals that your situation has become more nuanced.

The hidden cost of DIY taxes

The biggest cost of DIY filing isn’t the software fee. It’s opportunity cost.

Missed strategies can include:

- Income timing decisions

- Retirement contribution optimization

- Capital gains planning

- Tax-efficient withdrawal sequencing

- Long-term planning opportunities

These rarely show up as “errors,” but they can materially affect outcomes over time.

How a professional approach is different

A professional firm doesn’t just ask what happened last year.

They ask:

- What’s changing?

- What decisions are coming?

- How do taxes fit into the bigger picture?

At wealthnest®, tax preparation is paired with financial planning to help clients understand not just what they owe, but why and what to do next.

Graduating from tax software isn’t about income level. It’s about complexity and confidence.