Many high earners hesitate to say this out loud, but it’s common to think:“My taxes aren’t that complicated. I’m just W-2.” On the surface, that feels reasonable. You’re not running a business. You’re not filing multiple entities. You get a paycheck, maybe a bonus, maybe equity compensation, and your employer withholds taxes automatically. The problem is that modern W-2 compensation …

IRS Letters: What the Heck Do They Mean? A Fun Guide to Understanding the Different Types

OK! Let’s talk about IRS letters and decipher the mysterious jargon that comes with them. If you’ve ever received a letter from the IRS, you know how nerve-wracking and confusing it can be. The language is often filled with jargon and confusing terms that make your head spin. But fear not, my friends! This blog post is here to help …

Potential Income Streams for Retired Women

Could you possibly arrange multiple income sources? On average, women receive 23% less Social Security income than men. In 2014 (the most recent year of data available), the average yearly Social Security benefit for a woman 65 or older was $13,150, compared to $17,106 for her male counterpart.1 This is one example of the income gap plaguing too many women …

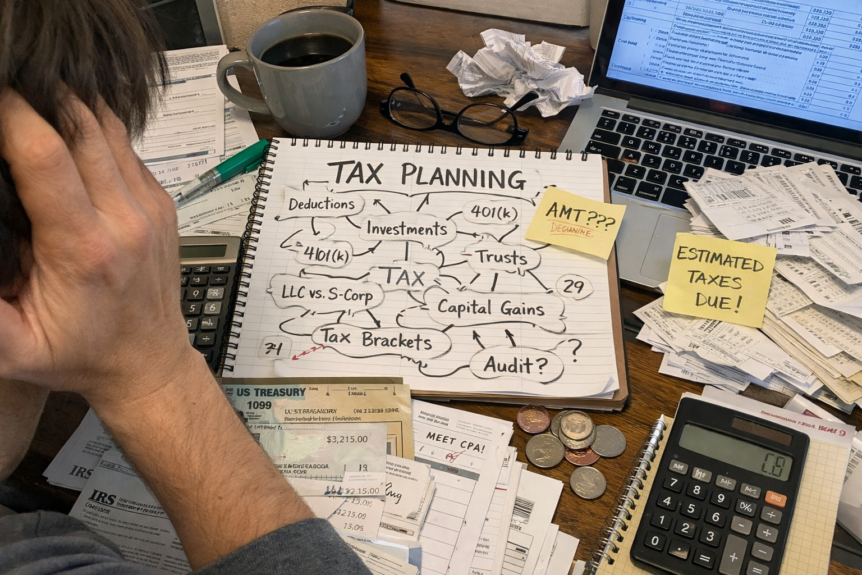

The Risks of D.I.Y. Investing & Financial Planning

In trying to do it yourself, there’s the chance you could do it all wrong. Many successful people refrain from trying to plan their financial futures. They delegate that job to professionals, as they lack the time, inclination, or knowledge to do it themselves. This makes sense. It takes years to gain a thorough understanding of financial market cycles and …

Lump-Sum vs. Monthly Pension

Weigh the tradeoffs before you make your decision. Lifelong income or one large payment? Companies that sponsor traditional pension plans are starting to offer their workers this retirement choice. It’s not an easy choice, and it’s usually irreversible. The case for the lump sum. All that money is yours now, ready to be used or invested as you wish. Your …

Women, Wealth, and Legacy Planning

Whether nurturing the values of children, fulfilling charitable goals, or making investment decisions that affect their own as well as their beneficiaries’ financial security, women play a central role in establishing and preserving family wealth. Consider these statistics:1 Women now control more than half of the investment wealth in the United States. 48% of estates worth more than …

Long Term Care Insurance: The Real Cost of Aging

There is a good possibility that you or your spouse will eventually require some form of long-term care. According to the U.S. Department of Health and Human Services, about 70% of people aged 65 or older will enter a nursing home for some period of time during their lifetimes.1 Whether you or your spouse will be among this group is …

Uncharted Waters-The Retirement Income Challenge

Summertime seems to always bring a new shark attack movie. This summer is no different with 47 Meters Down. The basic plot of the movie has divers in a cage dropped down for the first time surrounded by sharks. What could possibly wrong? Many soon to be and current retirees are also facing a similar challenge in generating income in …

Pension Income Planning

Pension Income Planning An employee nearing retirement may face a dilemma when it comes to choosing his or her pension. Pension options from a defined benefit retirement plan generally include a lifetime payment with no survivor benefit, a joint and 50% survivor payment, or a joint and 100% survivor payment. The joint and survivor benefits are reduced amounts from the …