Traditional tax preparation is excellent at one thing: reporting the past. For many households, that’s enough. But as income grows, relying solely on year-to-year tax prep often creates blind spots that only become obvious years later. High earners don’t usually overpay taxes because of missed deductions. They overpay because no one is helping them look ahead. When income fluctuates due …

Do I Need a Tax Strategist If I’m Just W-2 With RSUs or Bonuses?

Many high earners hesitate to say this out loud, but it’s common to think:“My taxes aren’t that complicated. I’m just W-2.” On the surface, that feels reasonable. You’re not running a business. You’re not filing multiple entities. You get a paycheck, maybe a bonus, maybe equity compensation, and your employer withholds taxes automatically. The problem is that modern W-2 compensation …

How to Find the Right Tax Preparer in Arizona When Your Finances Aren’t Simple

Searching for a tax preparer in Arizona can feel deceptively easy. A quick search returns dozens of options, all promising accuracy, speed, and experience. But once your finances extend beyond a straightforward return, the question changes. It’s no longer “Who can file this?” It becomes “Who actually understands what’s going on?” Why Arizona adds an extra layer of complexity Arizona …

When Should You Stop Using TurboTax and Work With a Professional?

Tax software is convenient, affordable, and effective for many people. But it isn’t designed to scale with complexity. So how do you know when it’s time to move on? TurboTax works best when life is predictable DIY tax software is ideal when: As soon as taxes require judgment, not just data entry, software reaches its limits. Signs it may be …

Capital Gains & Distribution Planning: Why Timing Matters

Why this is important now Smart planning strategies Tax efficiency isn’t about avoiding gains — it’s about aligning them with your bigger financial picture. At wealthnest®, we work with clients to build portfolios that grow while keeping tax surprises under control. Rising capital gains distributions and overlooked interest income don’t have to catch you off guard. With the right planning, …

The Tax Advantages of a Brokerage Account in a Community Property State

For couples living in a community property state, a brokerage account can offer unique tax benefits—especially when it comes to estate planning and investment flexibility. Two of the biggest advantages are the step-up in basis and the freedom to liquidate investments on your own terms. 1. Step-Up in Basis at the First Spouse’s PassingIn a community property state, when one spouse …

The Tax Trap of Inherited IRAs: What Beneficiaries Must Know Now

Receiving an inheritance might seem like a financial windfall—but if that inheritance includes a traditional IRA, it may come with an unexpected side effect: a substantial tax bill. Thanks to recent changes from the SECURE Act, many beneficiaries now face new rules and tighter timelines when it comes to inherited retirement accounts. If you’re not careful, you could end up …

Roth Conversions in 2025: A Smart Move Before Potential Tax Hikes?

As we near the end of 2025, taxpayers face a unique opportunity—one that may disappear with the sunset of the Tax Cuts and Jobs Act (TCJA). Among the most powerful moves available to those looking to reduce long-term tax burdens is a Roth conversion. For many individuals, converting pre-tax retirement accounts to Roth IRAs in 2025 could be a smart …

What the Expiration of the Tax Cuts and Jobs Act Could Mean for Your Taxes in 2026

The Tax Cuts and Jobs Act (TCJA), passed in 2017, ushered in sweeping changes to the U.S. tax code—reducing tax rates, doubling the standard deduction, limiting certain itemized deductions, and increasing estate tax exemptions. But many of these provisions were temporary, and without congressional intervention, they are set to expire at the end of 2025. If Congress allows the TCJA …

When Should I Hire A Tax Professional

When it comes to handling your taxes, it can often feel like a daunting task. With complex tax laws and ever-changing regulations, it’s no wonder that many individuals and businesses struggle to navigate the process on their own. While there are certainly instances where DIY tax preparation can be sufficient, there are also times when seeking professional help is not …

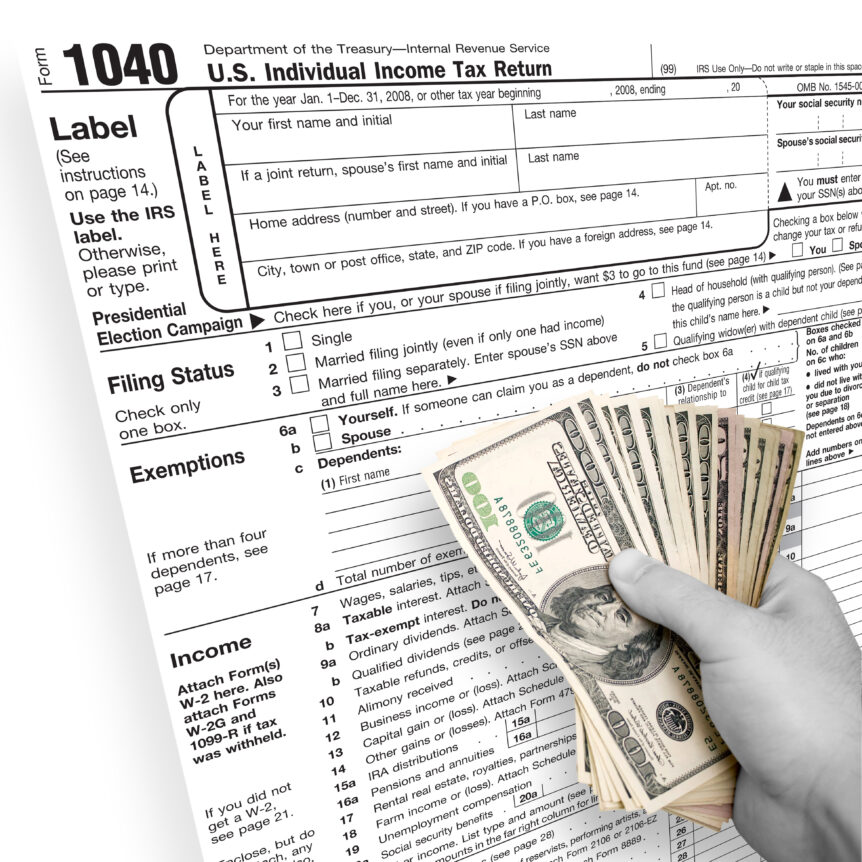

Upcoming Tax Changes For 2023

Overview of Personal Tax Filing Changes for 2023 As we approach the new year, it’s important to stay informed about the changes that will affect our personal tax filing for 2023. The tax landscape is constantly evolving, with new regulations and requirements being implemented. In this blog post, we provide an overview of the personal tax filing changes for 2023, …