There’s a common misconception that higher income leaves fewer tax options. In practice, higher income often magnifies the importance of every decision. As income rises, so does exposure to: A small planning mistake at lower income might be annoying. The same mistake at higher income can follow you for decades. Tax planning at higher income levels is not about chasing …

Why Year-to-Year Tax Prep Fails High Earners

Traditional tax preparation is excellent at one thing: reporting the past. For many households, that’s enough. But as income grows, relying solely on year-to-year tax prep often creates blind spots that only become obvious years later. High earners don’t usually overpay taxes because of missed deductions. They overpay because no one is helping them look ahead. When income fluctuates due …

Do I Need a Tax Strategist If I’m Just W-2 With RSUs or Bonuses?

Many high earners hesitate to say this out loud, but it’s common to think:“My taxes aren’t that complicated. I’m just W-2.” On the surface, that feels reasonable. You’re not running a business. You’re not filing multiple entities. You get a paycheck, maybe a bonus, maybe equity compensation, and your employer withholds taxes automatically. The problem is that modern W-2 compensation …

Why Arizona Retirees Need a Different Kind of Tax Planning

Retirement changes the way taxes work. For Arizona residents, those changes often arrive faster and with more complexity than expected. Many retirees assume that once they stop working, taxes will become simpler. In reality, retirement often replaces one income source with several, each taxed differently and each affecting the others. The shift from earning to withdrawing During working years, taxes …

What “Fiduciary” Actually Means for Arizona Tax and Financial Planning Clients

The word fiduciary gets used a lot in financial conversations, but it’s rarely explained clearly. Many people assume it’s a credential or a title. Others think it’s just marketing language. In reality, fiduciary is a legal and ethical standard, and understanding what it actually means can make a meaningful difference in how tax and financial decisions are made—especially for Arizona …

How to Find the Right Tax Preparer in Arizona When Your Finances Aren’t Simple

Searching for a tax preparer in Arizona can feel deceptively easy. A quick search returns dozens of options, all promising accuracy, speed, and experience. But once your finances extend beyond a straightforward return, the question changes. It’s no longer “Who can file this?” It becomes “Who actually understands what’s going on?” Why Arizona adds an extra layer of complexity Arizona …

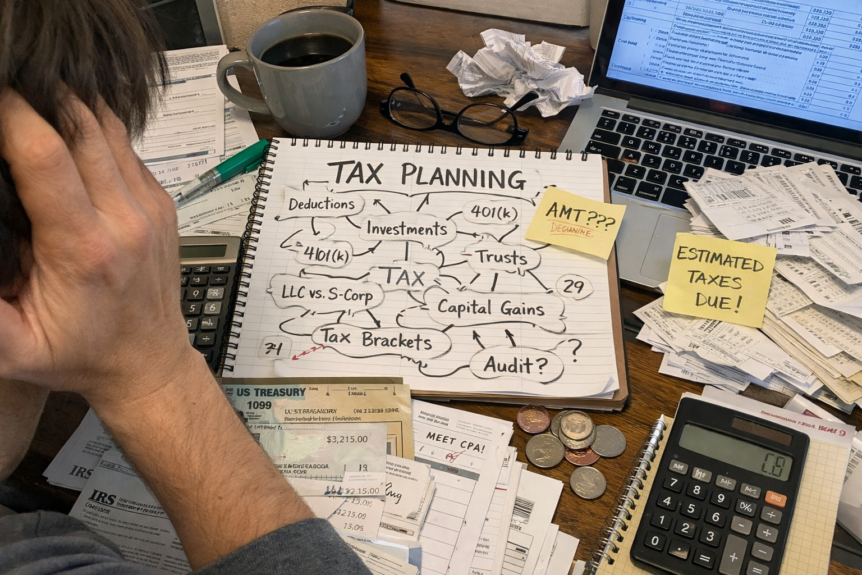

When Your Tax Questions Stop Being About Filing and Start Being About Decisions

Most people don’t go looking for a new tax professional because they want someone to type numbers into a form. They start looking because the questions they’re asking no longer have simple answers. At first, tax season is transactional. You report what happened, you file, you move on. But over time, the questions change. Instead of “Did I enter this …

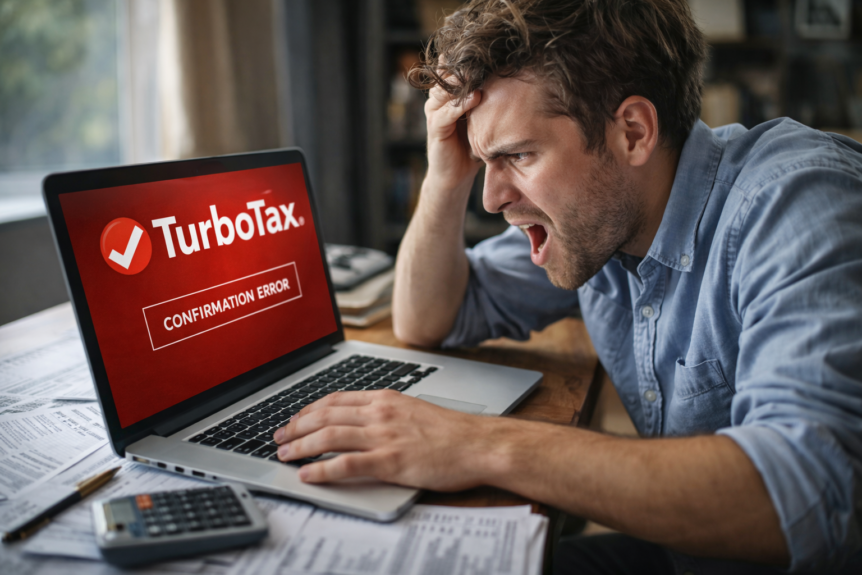

When Should You Stop Using TurboTax and Work With a Professional?

Tax software is convenient, affordable, and effective for many people. But it isn’t designed to scale with complexity. So how do you know when it’s time to move on? TurboTax works best when life is predictable DIY tax software is ideal when: As soon as taxes require judgment, not just data entry, software reaches its limits. Signs it may be …

What Makes a Tax Situation “Complicated” (and When DIY Tax Prep Stops Making Sense)

Most people don’t wake up one day and think, “My taxes are complicated now.”Instead, complexity creeps in quietly until tax season feels stressful, uncertain, or risky. So what actually makes a tax situation “complicated”? And how do you know when it’s time to move beyond DIY software? Common signs your tax situation is becoming complex A tax return typically becomes …

Turning 50+? Don’t Miss These Retirement & Tax Opportunities

Crossing age 50 or 65 isn’t just another birthday — it unlocks new opportunities that can make a significant difference in your retirement planning. These milestones provide ways to increase savings, reduce taxes, and add flexibility to your long-term income strategy. Why age matters in tax planning What this means for you These provisions are designed to help you save …

Capital Gains & Distribution Planning: Why Timing Matters

Why this is important now Smart planning strategies Tax efficiency isn’t about avoiding gains — it’s about aligning them with your bigger financial picture. At wealthnest®, we work with clients to build portfolios that grow while keeping tax surprises under control. Rising capital gains distributions and overlooked interest income don’t have to catch you off guard. With the right planning, …