Many high earners hesitate to say this out loud, but it’s common to think:“My taxes aren’t that complicated. I’m just W-2.” On the surface, that feels reasonable. You’re not running a business. You’re not filing multiple entities. You get a paycheck, maybe a bonus, maybe equity compensation, and your employer withholds taxes automatically. The problem is that modern W-2 compensation …

When Should You Stop Using TurboTax and Work With a Professional?

Tax software is convenient, affordable, and effective for many people. But it isn’t designed to scale with complexity. So how do you know when it’s time to move on? TurboTax works best when life is predictable DIY tax software is ideal when: As soon as taxes require judgment, not just data entry, software reaches its limits. Signs it may be …

Capital Gains & Distribution Planning: Why Timing Matters

Why this is important now Smart planning strategies Tax efficiency isn’t about avoiding gains — it’s about aligning them with your bigger financial picture. At wealthnest®, we work with clients to build portfolios that grow while keeping tax surprises under control. Rising capital gains distributions and overlooked interest income don’t have to catch you off guard. With the right planning, …

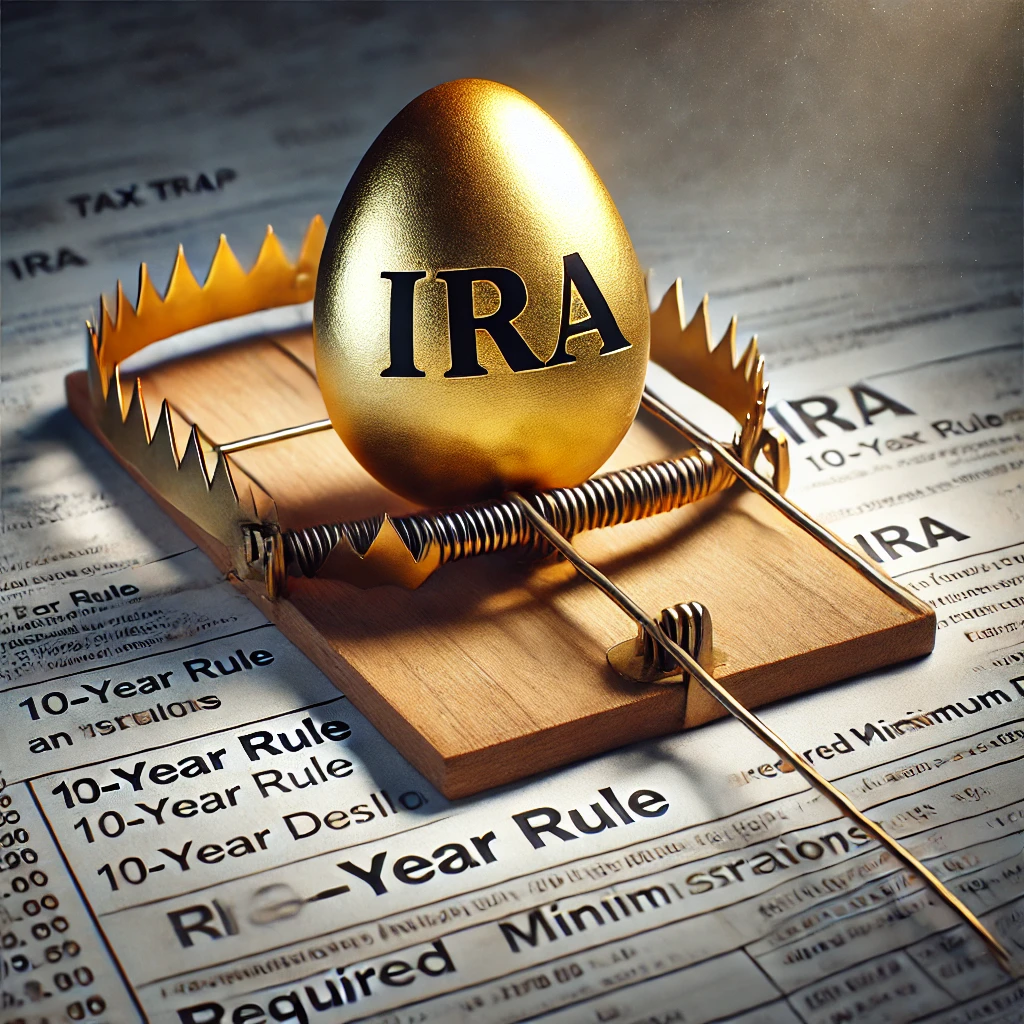

The Tax Trap of Inherited IRAs: What Beneficiaries Must Know Now

Receiving an inheritance might seem like a financial windfall—but if that inheritance includes a traditional IRA, it may come with an unexpected side effect: a substantial tax bill. Thanks to recent changes from the SECURE Act, many beneficiaries now face new rules and tighter timelines when it comes to inherited retirement accounts. If you’re not careful, you could end up …

Roth Conversions in 2025: A Smart Move Before Potential Tax Hikes?

As we near the end of 2025, taxpayers face a unique opportunity—one that may disappear with the sunset of the Tax Cuts and Jobs Act (TCJA). Among the most powerful moves available to those looking to reduce long-term tax burdens is a Roth conversion. For many individuals, converting pre-tax retirement accounts to Roth IRAs in 2025 could be a smart …

What the Expiration of the Tax Cuts and Jobs Act Could Mean for Your Taxes in 2026

The Tax Cuts and Jobs Act (TCJA), passed in 2017, ushered in sweeping changes to the U.S. tax code—reducing tax rates, doubling the standard deduction, limiting certain itemized deductions, and increasing estate tax exemptions. But many of these provisions were temporary, and without congressional intervention, they are set to expire at the end of 2025. If Congress allows the TCJA …

When Should I Hire A Tax Professional

When it comes to handling your taxes, it can often feel like a daunting task. With complex tax laws and ever-changing regulations, it’s no wonder that many individuals and businesses struggle to navigate the process on their own. While there are certainly instances where DIY tax preparation can be sufficient, there are also times when seeking professional help is not …

Upcoming Tax Changes For 2023

Overview of Personal Tax Filing Changes for 2023 As we approach the new year, it’s important to stay informed about the changes that will affect our personal tax filing for 2023. The tax landscape is constantly evolving, with new regulations and requirements being implemented. In this blog post, we provide an overview of the personal tax filing changes for 2023, …

Maximizing Your Retirement Nest Egg: The Power of Tax Planning

As we look towards our golden years, retirement planning becomes increasingly necessary to ensure a financially secure future. However, one aspect that is often underestimated in this process is tax planning. While taxes may seem like an inevitable burden, proper tax planning can significantly impact the size of your retirement nest egg. In this blog, we will discuss the importance …

6 Ways to Fund a Working Mom’s Retirement

As a working mom, whole weeks may go by without the chance to sit down or even think. You’re managing a career, making decisions for your family, and caring for kids and often parents, too. It’s not easy, then, to hear about one more job that needs your immediate attention: retirement planning. But let’s just be blunt, women are almost …

Dollars and Sense

What influences your spending choices? Social media can pressure you to spend more than necessary. We have all seen our friends post images of an expensive dinner,a pricy resort stay, a new car, maybe even their first condo or house. Seeing these message can influence your spending habits. Millennials are known for frugality, but the reality may differ. An American …