Many high earners hesitate to say this out loud, but it’s common to think:

“My taxes aren’t that complicated. I’m just W-2.”

On the surface, that feels reasonable. You’re not running a business. You’re not filing multiple entities. You get a paycheck, maybe a bonus, maybe equity compensation, and your employer withholds taxes automatically.

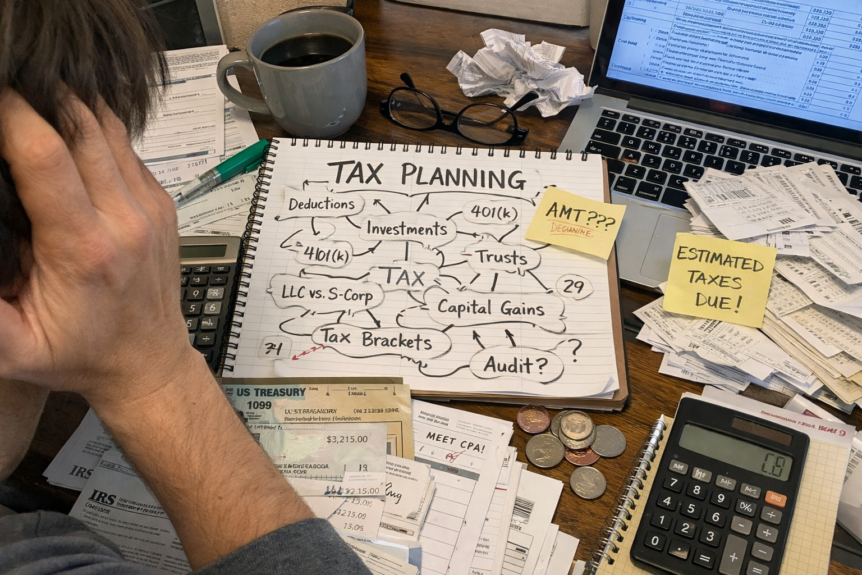

The problem is that modern W-2 compensation is no longer simple.

Bonuses, restricted stock units (RSUs), deferred compensation, and performance incentives introduce timing and coordination issues that traditional tax preparation is not designed to solve.

RSUs, for example, are often misunderstood. They are taxed as ordinary income when they vest, not when you sell the shares. The withholding applied at vesting is frequently a flat rate that does not match your actual marginal tax bracket. That mismatch can quietly create underpayment issues, surprise balances due, or missed planning opportunities.

Bonuses add another layer. A strong bonus year can push income into higher brackets, reduce deductions or credits, and affect future decisions you don’t immediately associate with taxes. Retirement planning, healthcare costs later in life, and even eligibility for certain strategies can all be impacted by how and when income hits.

A tax preparer can tell you what happened last year.

A tax strategist helps answer a different question:

“Given how I’m paid, what choices do I actually have?”

If your compensation is variable, layered, or increasing, tax planning becomes less about filing accuracy and more about sequencing decisions across time. That’s usually the moment when people realize they need more than a once-a-year tax conversation.

Not sure if this applies to you?

Many professionals don’t realize their compensation has become more complex until the consequences show up years later. If your income includes bonuses, RSUs, or other incentives, a short conversation can help clarify whether tax planning would add value or if your current approach still makes sense.