There’s no magic income number where tax prep suddenly stops being effective. Instead, there’s a point where complexity overtakes simplicity. For many people, that point arrives when income growth brings more decisions: At that stage, the question is no longer whether your return is filed correctly.It becomes whether the structure of your financial life is efficient. Basic tax prep answers …

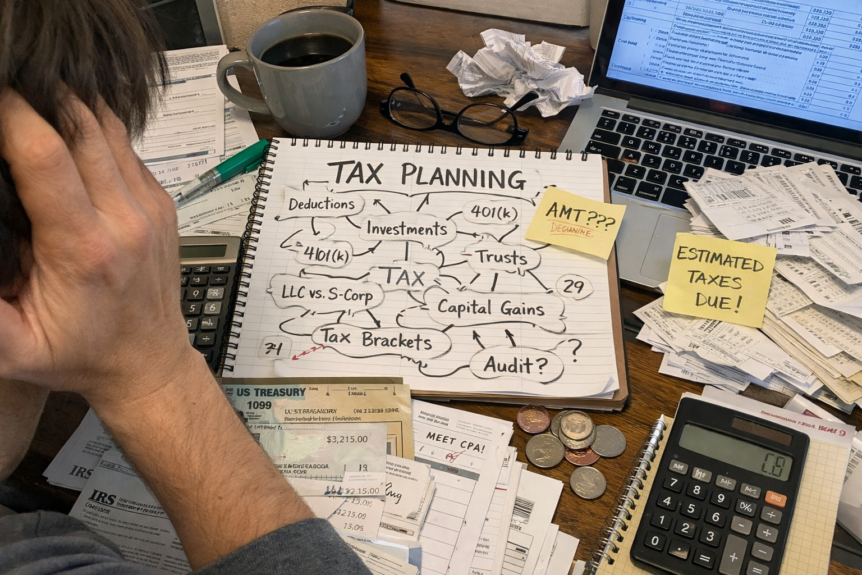

Why Year-to-Year Tax Prep Fails High Earners

Traditional tax preparation is excellent at one thing: reporting the past. For many households, that’s enough. But as income grows, relying solely on year-to-year tax prep often creates blind spots that only become obvious years later. High earners don’t usually overpay taxes because of missed deductions. They overpay because no one is helping them look ahead. When income fluctuates due …

Do I Need a Tax Strategist If I’m Just W-2 With RSUs or Bonuses?

Many high earners hesitate to say this out loud, but it’s common to think:“My taxes aren’t that complicated. I’m just W-2.” On the surface, that feels reasonable. You’re not running a business. You’re not filing multiple entities. You get a paycheck, maybe a bonus, maybe equity compensation, and your employer withholds taxes automatically. The problem is that modern W-2 compensation …

How to Find the Right Tax Preparer in Arizona When Your Finances Aren’t Simple

Searching for a tax preparer in Arizona can feel deceptively easy. A quick search returns dozens of options, all promising accuracy, speed, and experience. But once your finances extend beyond a straightforward return, the question changes. It’s no longer “Who can file this?” It becomes “Who actually understands what’s going on?” Why Arizona adds an extra layer of complexity Arizona …

When Should You Stop Using TurboTax and Work With a Professional?

Tax software is convenient, affordable, and effective for many people. But it isn’t designed to scale with complexity. So how do you know when it’s time to move on? TurboTax works best when life is predictable DIY tax software is ideal when: As soon as taxes require judgment, not just data entry, software reaches its limits. Signs it may be …

What Makes a Tax Situation “Complicated” (and When DIY Tax Prep Stops Making Sense)

Most people don’t wake up one day and think, “My taxes are complicated now.”Instead, complexity creeps in quietly until tax season feels stressful, uncertain, or risky. So what actually makes a tax situation “complicated”? And how do you know when it’s time to move beyond DIY software? Common signs your tax situation is becoming complex A tax return typically becomes …

Upcoming Tax Changes For 2023

Overview of Personal Tax Filing Changes for 2023 As we approach the new year, it’s important to stay informed about the changes that will affect our personal tax filing for 2023. The tax landscape is constantly evolving, with new regulations and requirements being implemented. In this blog post, we provide an overview of the personal tax filing changes for 2023, …

Long-Term Care Choices

A look at three other long-term care (LTC) coverage options. Traditional long-term care insurance has grown costlier—and some of those who buy it may never need the coverage. Are potentially cheaper, flexible options available? Yes. 1 Hybrid life insurance policies with LTC riders. These life insurance policies have LTC coverage options available for a fee that you can use if …

Dollars and Sense

What influences your spending choices? Social media can pressure you to spend more than necessary. We have all seen our friends post images of an expensive dinner,a pricy resort stay, a new car, maybe even their first condo or house. Seeing these message can influence your spending habits. Millennials are known for frugality, but the reality may differ. An American …

Your Financial Retirement Feedback Loop

Sometimes you need a “sounding board” for your ideas and concerns. When you have financial questions or ideas, you need someone to listen. A professional can listen and help provide insight about possible financial moves you could make—plus give you guidance regarding your options. Every retirement saver needs to measure financial progress. Checking in with your financial professional every so …

When Spouses Combine Finances

After you marry, to what degree should your financial lives be shared? Many couples who marry also wed their finances together. Whether they partly or fully merge their finances, many couples may see more advantages than disadvantages to taking this step. Some young married couples decide to create joint accounts early. Without a joint checking or savings account, the matter …