Many high earners hesitate to say this out loud, but it’s common to think:“My taxes aren’t that complicated. I’m just W-2.” On the surface, that feels reasonable. You’re not running a business. You’re not filing multiple entities. You get a paycheck, maybe a bonus, maybe equity compensation, and your employer withholds taxes automatically. The problem is that modern W-2 compensation …

How to Find the Right Tax Preparer in Arizona When Your Finances Aren’t Simple

Searching for a tax preparer in Arizona can feel deceptively easy. A quick search returns dozens of options, all promising accuracy, speed, and experience. But once your finances extend beyond a straightforward return, the question changes. It’s no longer “Who can file this?” It becomes “Who actually understands what’s going on?” Why Arizona adds an extra layer of complexity Arizona …

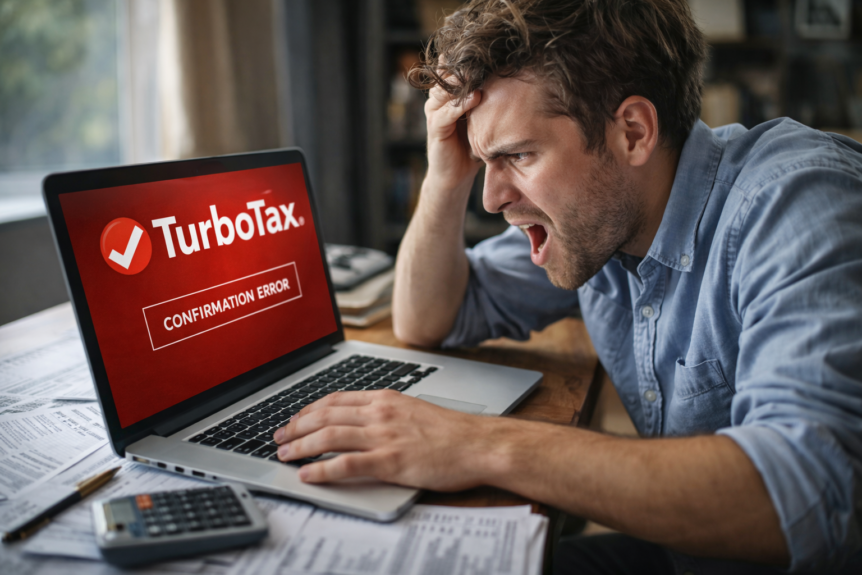

When Should You Stop Using TurboTax and Work With a Professional?

Tax software is convenient, affordable, and effective for many people. But it isn’t designed to scale with complexity. So how do you know when it’s time to move on? TurboTax works best when life is predictable DIY tax software is ideal when: As soon as taxes require judgment, not just data entry, software reaches its limits. Signs it may be …

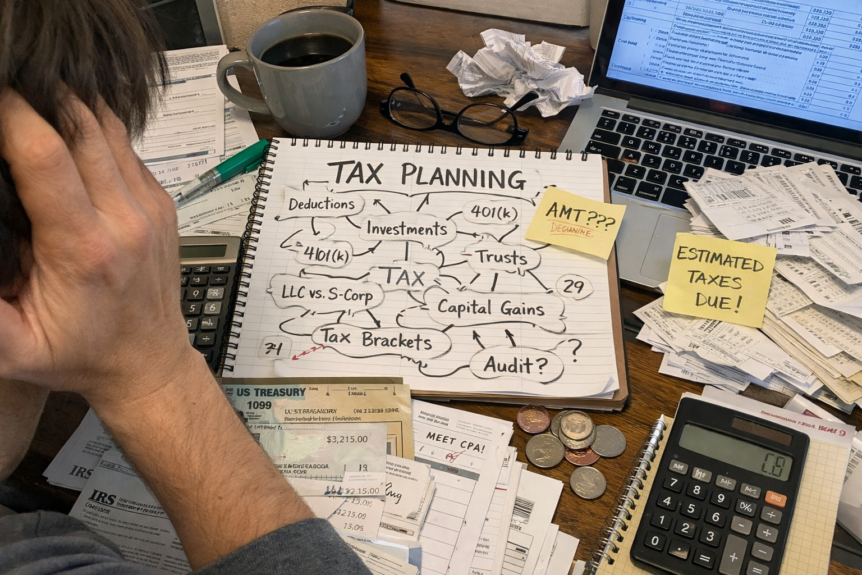

What Makes a Tax Situation “Complicated” (and When DIY Tax Prep Stops Making Sense)

Most people don’t wake up one day and think, “My taxes are complicated now.”Instead, complexity creeps in quietly until tax season feels stressful, uncertain, or risky. So what actually makes a tax situation “complicated”? And how do you know when it’s time to move beyond DIY software? Common signs your tax situation is becoming complex A tax return typically becomes …

Maximizing Your Retirement Nest Egg: The Power of Tax Planning

As we look towards our golden years, retirement planning becomes increasingly necessary to ensure a financially secure future. However, one aspect that is often underestimated in this process is tax planning. While taxes may seem like an inevitable burden, proper tax planning can significantly impact the size of your retirement nest egg. In this blog, we will discuss the importance …

Potential Income Streams for Retired Women

Could you possibly arrange multiple income sources? On average, women receive 23% less Social Security income than men. In 2014 (the most recent year of data available), the average yearly Social Security benefit for a woman 65 or older was $13,150, compared to $17,106 for her male counterpart.1 This is one example of the income gap plaguing too many women …

How Inflation Threatens Retirees

Its effect is subtle, yet significant. Even mild inflation eventually reduces the value of a dollar. If consumer prices rise just 2% a year for the next 25 years, $50,000 will buy the equivalent of $30,477 by the end of 2041. Or to put it another way, a car that costs $50,000 today will cost $82,030 by then. If inflation …

Planning the Withdrawal of Your Retirement Assets

You’ve worked long and hard to accumulate your retirement assets that you are using to help finance your retirement. Now, it’s time to start drawing down those assets. Exactly how you liquidate your assets will affect your tax and impact how long those assets last, so it pays to plan a withdrawal strategy that is efficient and maximizes the benefits …

Uncharted Waters-The Retirement Income Challenge

Summertime seems to always bring a new shark attack movie. This summer is no different with 47 Meters Down. The basic plot of the movie has divers in a cage dropped down for the first time surrounded by sharks. What could possibly wrong? Many soon to be and current retirees are also facing a similar challenge in generating income in …

Time to Brush Up on Your IRA Facts

If you are opening an (Individual Retirement Account) IRA for the first time or need a refresher course on the specifics of IRA ownership, here are some facts for your consideration. IRA’s in America IRAs continue to play an increasingly prominent role in the retirement saving strategies of Americans. According to the Investment Company Institute (ICI), the U.S. retirement market …

The Plan is to Live Into Retirement

When do you want to retire? Yesterday? Is your money going to last? It’s simple. Just tell me when you are going to die and we can come up with the perfect plan for your retirement. If you are like most of my clients, you are working away and putting away money for that future retirement date. But what if …

- Page 1 of 2

- 1

- 2