Many high earners hesitate to say this out loud, but it’s common to think:“My taxes aren’t that complicated. I’m just W-2.” On the surface, that feels reasonable. You’re not running a business. You’re not filing multiple entities. You get a paycheck, maybe a bonus, maybe equity compensation, and your employer withholds taxes automatically. The problem is that modern W-2 compensation …

How to Find the Right Tax Preparer in Arizona When Your Finances Aren’t Simple

Searching for a tax preparer in Arizona can feel deceptively easy. A quick search returns dozens of options, all promising accuracy, speed, and experience. But once your finances extend beyond a straightforward return, the question changes. It’s no longer “Who can file this?” It becomes “Who actually understands what’s going on?” Why Arizona adds an extra layer of complexity Arizona …

When Should You Stop Using TurboTax and Work With a Professional?

Tax software is convenient, affordable, and effective for many people. But it isn’t designed to scale with complexity. So how do you know when it’s time to move on? TurboTax works best when life is predictable DIY tax software is ideal when: As soon as taxes require judgment, not just data entry, software reaches its limits. Signs it may be …

What Makes a Tax Situation “Complicated” (and When DIY Tax Prep Stops Making Sense)

Most people don’t wake up one day and think, “My taxes are complicated now.”Instead, complexity creeps in quietly until tax season feels stressful, uncertain, or risky. So what actually makes a tax situation “complicated”? And how do you know when it’s time to move beyond DIY software? Common signs your tax situation is becoming complex A tax return typically becomes …

Capital Gains & Distribution Planning: Why Timing Matters

Why this is important now Smart planning strategies Tax efficiency isn’t about avoiding gains — it’s about aligning them with your bigger financial picture. At wealthnest®, we work with clients to build portfolios that grow while keeping tax surprises under control. Rising capital gains distributions and overlooked interest income don’t have to catch you off guard. With the right planning, …

The Tax Advantages of a Brokerage Account in a Community Property State

For couples living in a community property state, a brokerage account can offer unique tax benefits—especially when it comes to estate planning and investment flexibility. Two of the biggest advantages are the step-up in basis and the freedom to liquidate investments on your own terms. 1. Step-Up in Basis at the First Spouse’s PassingIn a community property state, when one spouse …

Strategic Tax Planning Tips for a Strong Financial Finish to the Year

Tax planning is a crucial aspect of financial management, especially as the end of the year approaches. With the right strategies in place, individuals and businesses in Chandler, Arizona can ensure they are making the most of available deductions and credits while minimizing their tax liabilities. Working with a knowledgeable tax professional can help navigate the complexities of tax laws …

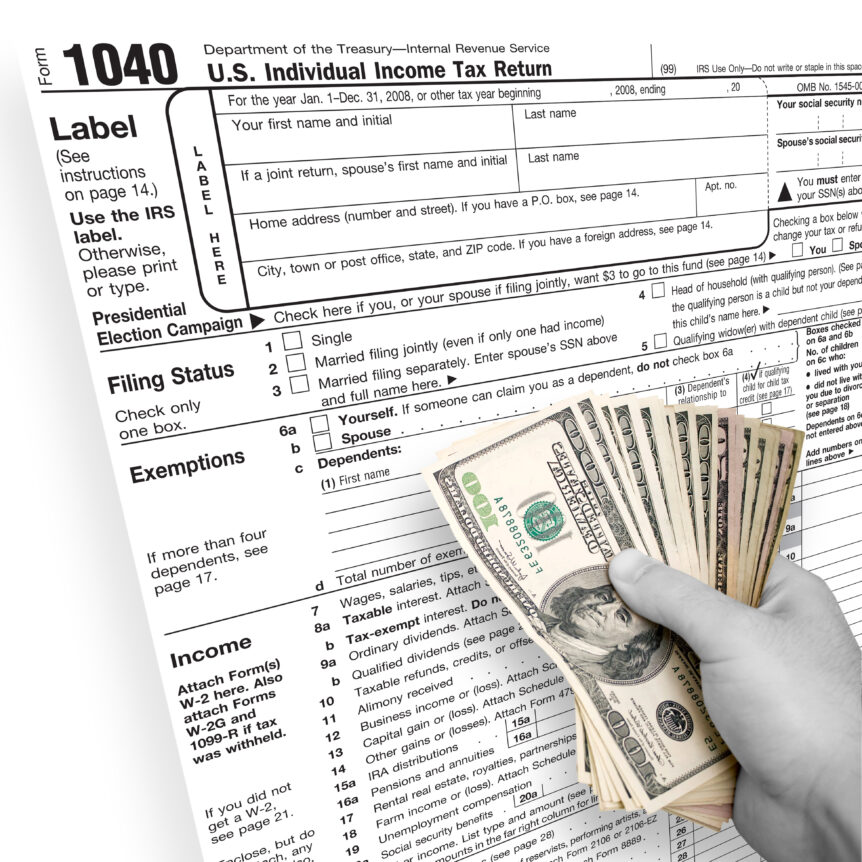

When Should I Hire A Tax Professional

When it comes to handling your taxes, it can often feel like a daunting task. With complex tax laws and ever-changing regulations, it’s no wonder that many individuals and businesses struggle to navigate the process on their own. While there are certainly instances where DIY tax preparation can be sufficient, there are also times when seeking professional help is not …

Upcoming Tax Changes For 2023

Overview of Personal Tax Filing Changes for 2023 As we approach the new year, it’s important to stay informed about the changes that will affect our personal tax filing for 2023. The tax landscape is constantly evolving, with new regulations and requirements being implemented. In this blog post, we provide an overview of the personal tax filing changes for 2023, …

Maximize Your Savings: The Hidden Benefits of Mid-Year Tax Planning

Tax planning is often seen as a task that only needs to be done once a year, right before the tax filing deadline. However, this common misconception can lead to missed opportunities for maximizing savings. Mid-year tax planning can provide a range of hidden benefits that can significantly impact your financial situation. By taking the time to review your tax …

Maximizing Your Retirement Nest Egg: The Power of Tax Planning

As we look towards our golden years, retirement planning becomes increasingly necessary to ensure a financially secure future. However, one aspect that is often underestimated in this process is tax planning. While taxes may seem like an inevitable burden, proper tax planning can significantly impact the size of your retirement nest egg. In this blog, we will discuss the importance …

- Page 1 of 2

- 1

- 2