Searching for a tax preparer in Arizona can feel deceptively easy. A quick search returns dozens of options, all promising accuracy, speed, and experience. But once your finances extend beyond a straightforward return, the question changes. It’s no longer “Who can file this?” It becomes “Who actually understands what’s going on?” Why Arizona adds an extra layer of complexity Arizona …

When Should You Stop Using TurboTax and Work With a Professional?

Tax software is convenient, affordable, and effective for many people. But it isn’t designed to scale with complexity. So how do you know when it’s time to move on? TurboTax works best when life is predictable DIY tax software is ideal when: As soon as taxes require judgment, not just data entry, software reaches its limits. Signs it may be …

What Makes a Tax Situation “Complicated” (and When DIY Tax Prep Stops Making Sense)

Most people don’t wake up one day and think, “My taxes are complicated now.”Instead, complexity creeps in quietly until tax season feels stressful, uncertain, or risky. So what actually makes a tax situation “complicated”? And how do you know when it’s time to move beyond DIY software? Common signs your tax situation is becoming complex A tax return typically becomes …

When Should I Hire A Tax Professional

When it comes to handling your taxes, it can often feel like a daunting task. With complex tax laws and ever-changing regulations, it’s no wonder that many individuals and businesses struggle to navigate the process on their own. While there are certainly instances where DIY tax preparation can be sufficient, there are also times when seeking professional help is not …

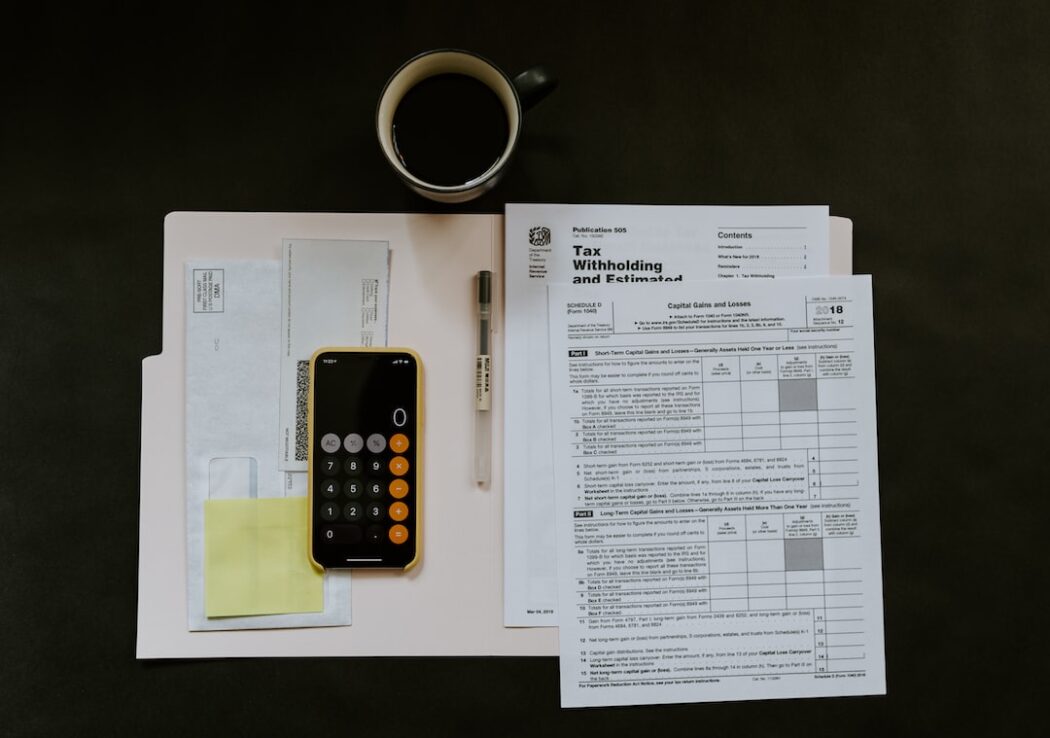

Upcoming Tax Changes For 2023

Overview of Personal Tax Filing Changes for 2023 As we approach the new year, it’s important to stay informed about the changes that will affect our personal tax filing for 2023. The tax landscape is constantly evolving, with new regulations and requirements being implemented. In this blog post, we provide an overview of the personal tax filing changes for 2023, …

Maximize Your Savings: The Hidden Benefits of Mid-Year Tax Planning

Tax planning is often seen as a task that only needs to be done once a year, right before the tax filing deadline. However, this common misconception can lead to missed opportunities for maximizing savings. Mid-year tax planning can provide a range of hidden benefits that can significantly impact your financial situation. By taking the time to review your tax …

Maximizing Your Retirement Nest Egg: The Power of Tax Planning

As we look towards our golden years, retirement planning becomes increasingly necessary to ensure a financially secure future. However, one aspect that is often underestimated in this process is tax planning. While taxes may seem like an inevitable burden, proper tax planning can significantly impact the size of your retirement nest egg. In this blog, we will discuss the importance …

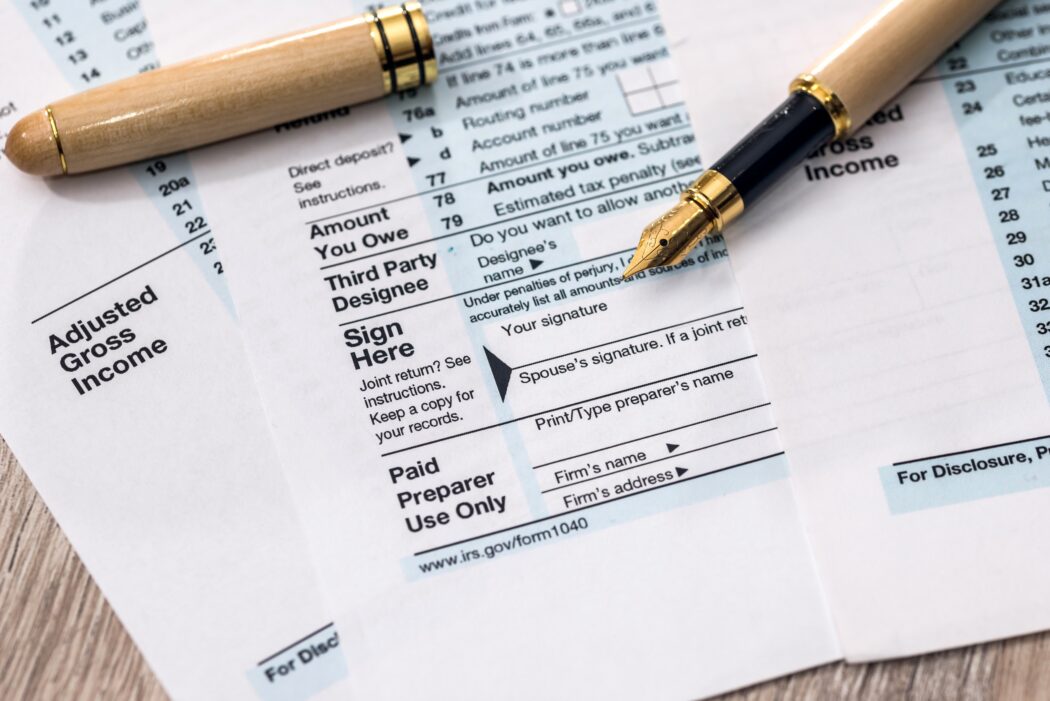

Options for Your Tax Refund

What should you do with the money? A look at some choices. Each year, about 70% of taxpayers receive federal tax refunds. The average IRS refund is substantial—$2,800. What could you do with a refund sent to you? You could invest that money. It could go into your workplace retirement plan, an Individual Retirement Account, or a college savings plan—preferably, …

A Look at the Gift Tax Exemption

How much can you gift in a year, and a lifetime? Federal tax rules allow you to give away millions of dollars during your lifetime. You can make five-figure gifts of money or property to other individuals in any given year. These gifts may be made without tax consequences … as long as they fall within the IRS annual …

Do You Consider Taxes as You Invest?

A few astute moves could help promote a better after-tax return. As you weigh risk vs. return, you may risk taking an eye off taxes. A focus on tax efficiency could help you improve the effective yield of your portfolio. You can try to cut or delay taxes linked to investing. Consider placing the most tax-efficient investments you have in …

Tax Season Isn’t Over

Tax filing day has passed us by for another year (unless you are on extension). Most people don’t start planning for their taxes until they start receiving documents. At this point your accountant is a glorified scorekeeper showing you what you owe or what you are getting back. Now is the time to start planning for 2017, especially with all …

- Page 1 of 2

- 1

- 2